tax refund calculator ontario 2022

Itemized deductions are a list of. DATEucator - Your 2022 Tax Refund Date.

Personal Income Tax Brackets Ontario 2021 Md Tax

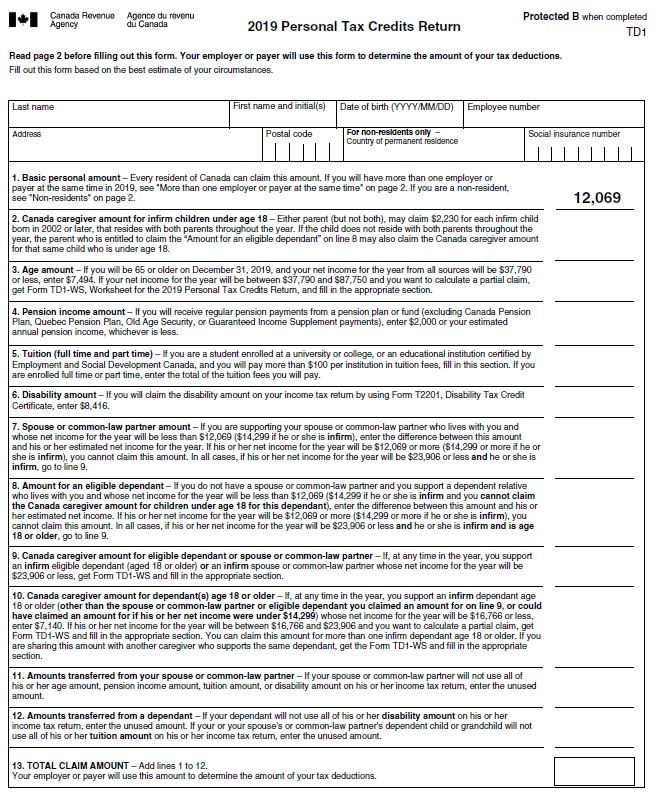

476 Provincial or territorial credits attach for 479 if it applies 479 Add lines 437 to 479.

. The Ontario land transfer tax for a home purchased for 500000 in Ottawa is 6475. If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043. Standard deductions lower your income by one fixed amount.

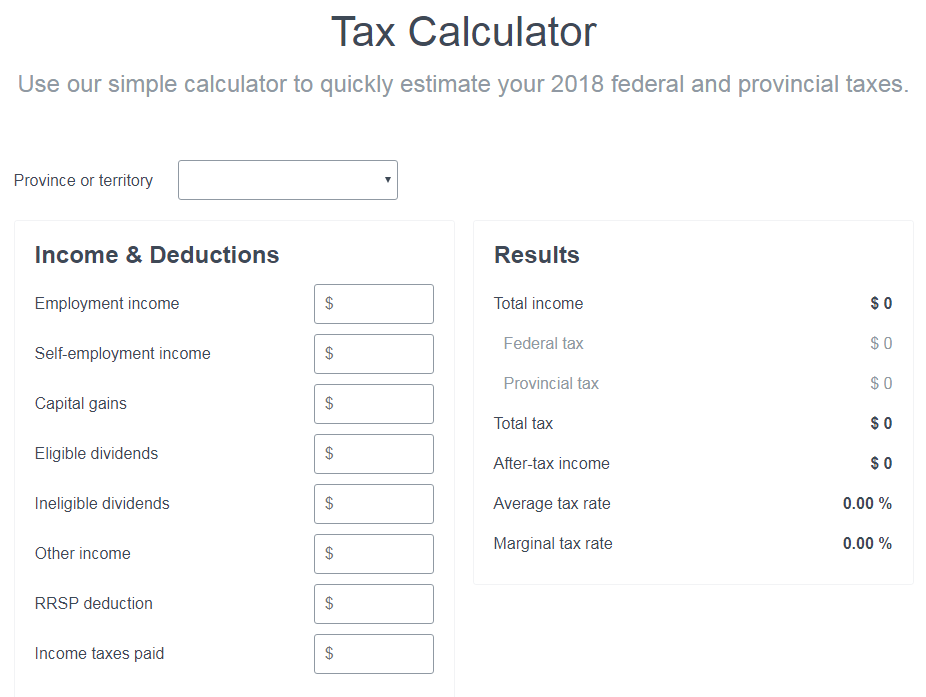

Ad Top-rated pros for any project. 2022 Income Tax Calculator Canada 2022 free Canada income tax calculator to quickly estimate your provincial taxes. These are your total credits.

Use our free 2022 Ontario income tax calculator to see how much you will pay in taxes. Use our free income tax calculator to find out what you might be getting this tax season. Childrens fitness tax credit.

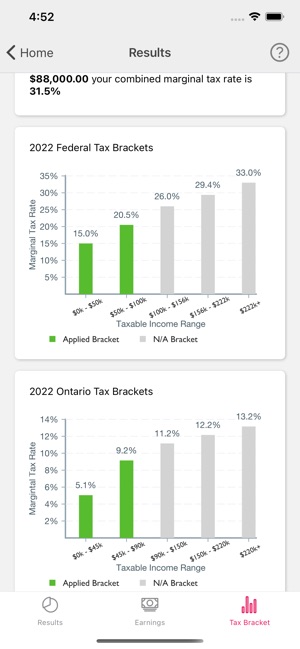

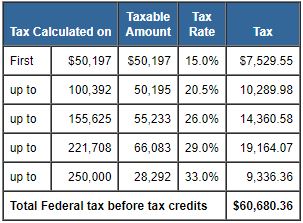

That means that your net pay will be 37957 per year or 3163 per month. The information deisplayed in the Ontario Tax Brackets for 2022 is used for the 2022 Ontario Tax Calculator. You can also explore Canadian federal tax brackets provincial.

2022 Tax Calculator Estimator - W-4-Pro. Calculate your combined federal and provincial tax bill in each province and territory. Newfoundland and Labrador NL.

Tax Refund Calculator 2022 Ontario. Income Tax Return Calculator Ontario 2022. Calculate your refund fast and easy with our tax refund estimator.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. 2022 Income Tax Calculator Ontario. This calculator will help you get the net tax income after tax the percentage of tax of each government provincial and.

2022 Personal tax calculator. The maximum tax refund is 4000 as the property is over 368000. Our tax refund calculator will show you how.

Ontario income tax rates in 2022 range from 505 to 1316. To lower the amount you owe the simplest way is to adjust your tax withholdings on your W-4. This is an optional tax refund.

That means that your net pay will be 37957 per year or 3163. X 15 459 Tax paid by instalments. W-4 Pro - Tax Return Based W-4 Form.

If you make 52000 a year. Income Tax Return Calculator Ontario 2022. It is not your tax refund.

This calculator is for 2022 Tax. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. The amount of income tax that was deducted from your.

Amounts earned up to 46226 are taxed at. Federal income tax rates in 2022 range from 15 to 33. Get better visibility to your tax bracket marginal tax rate.

Ad Estimate your 2021 income tax return with our free calculator tool. The calculator reflects known rates as of June 1 2022. Our W-4 Calculator can help you determine how to update your W-4 to get your desired tax.

5 rows The tax rates for Ontario in 2022 are as follows. Calculate the total income taxes of the Ontario residents for 2022. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

Get better visibility to your tax bracket marginal tax rate average tax rate payroll tax deductions tax. 2022 Ontario Income Tax Calculator. This calculator will help you get the net tax income after tax the percentage of tax of each government provincial and.

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Taxtips Ca How Is Personal Income Tax Calculated In Canada

Ontario Tax Brackets For 2022 Savvy New Canadians

Tax Return Estimator Unbeatable Offers 66 Off Aarav Co

Tax Day 2022 10 Tax Changes That Could Impact The Size Of Your Refund Cnet

New York Income Tax Calculator Smartasset

Minnesota State Income Tax Mn Tax Calculator Community Tax

![]()

Canadian Tax Refund Calculator

The Complete J1 Student Guide To Tax In The Us

Ey 2022 Tax Calculators Rates Ey Canada

Excel Savings Calculator Excel Savings Spreadsheet Excel Etsy

Simple Tax Calculator For 2022 Cloudtax

Canadian Tax Brackets Marginal Tax Vs Average Tax Retire Happy

Calculating Your Tax Refund Canada 2022 Turbotax Canada Tips

Completing Form 1040 And The Foreign Earned Income Tax Worksheet

Apply My Tax Refund To Next Year S Taxes H R Block